In at present's financial panorama, cash loans without credit checks have gotten more and more common among borrowers in search of quick entry to funds. One of the vital sought-after amounts in this category is $5000, a sum that may cowl a wide range of unexpected expenses, from medical payments to car repairs. Should you loved this informative article and you would like to receive more details about places That loan money with no credit kindly visit our own web site. This article explores the dynamics of money loans, significantly those that do not require a credit check, and examines their implications for borrowers.

The Enchantment of money Loans Without Credit score Checks

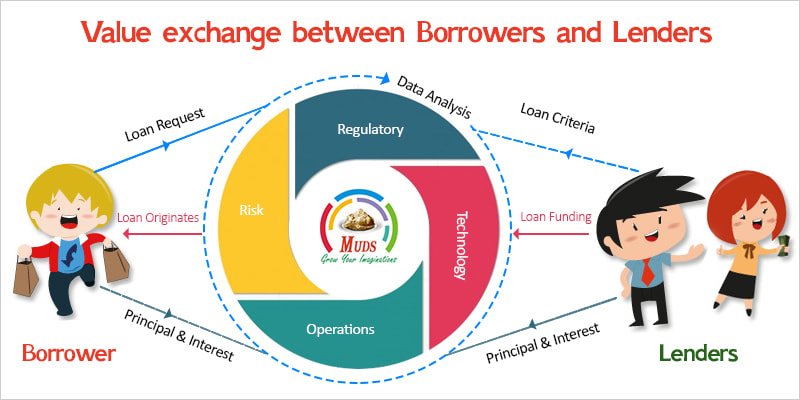

Money loans without credit score checks present a sexy possibility for people who may have poor credit score histories or those who favor a extra streamlined utility process. Conventional lending establishments typically rely closely on credit score scores to find out a borrower's eligibility, which can exclude many potential borrowers. In contrast, various lenders who supply no credit report loans credit check loans focus more on a borrower's income and skill to repay the loan, making these finance loans no credit check accessible to a broader viewers.

The enchantment of obtaining $5000 in cash shortly cannot be overstated. Many people face financial emergencies that require speedy funding, and the standard banking system can be slow and cumbersome. In distinction, no credit check loans typically supply sooner approval times, allowing borrowers to obtain funds within a day or two. This immediacy might be essential in conditions where timing is crucial, equivalent to medical emergencies or pressing residence repairs.

The applying Course of

The application course of for a cash loan with no credit score check is mostly easy. Most lenders require basic personal info, proof of earnings, and typically, bank statements. This simplicity is a major draw for borrowers who may not have the time or resources to navigate the complexities of traditional loans.

Online purposes have further streamlined the process. Borrowers can apply from the comfort of their homes, and plenty of lenders provide immediate pre-approval choices. This convenience is particularly appealing to youthful borrowers who are accustomed to dealing with monetary transactions online.

Interest Charges and Fees

Whereas cash loans with out credit checks offer accessibility, they usually include increased curiosity rates in comparison with traditional loans. Lenders assume a better danger by not evaluating credit score scores, which is typically reflected within the terms of the loan. Borrowers should be aware that the annual percentage charge (APR) for these loans can range significantly, sometimes exceeding 30% or extra, depending on the lender and the borrower's financial scenario.

Additionally, many lenders might charge origination charges or other administrative costs. It is important for borrowers to learn the effective print and perceive the total value of the loan earlier than proceeding. Transparency in fees is essential, as hidden costs can result in borrowers facing extra vital monetary burdens than anticipated.

Risks Involved

The comfort of money loans without credit checks comes with inherent dangers. Borrowers may find themselves in a cycle of debt if they are unable to repay the loan on time. Many lenders offer the choice to roll over the loan, which may result in further fees and a longer repayment interval, compounding the debt.

Moreover, the lack of credit score checks can entice predatory lending practices. Some lenders could exploit susceptible borrowers by offering loans with exorbitant curiosity charges and unfavorable terms. It's important for people searching for these big loans no credit check to conduct thorough research and choose reputable lenders. On-line evaluations, Better Enterprise Bureau scores, and consumer safety businesses can serve as invaluable resources in this regard.

Alternate options to contemplate

Whereas cash loans with out credit checks will be a quick resolution to monetary woes, they aren't the one possibility accessible. Borrowers should consider alternative lending options that may supply extra favorable terms. As an illustration, credit unions often present personal loans with lower interest rates, even for these with less-than-excellent credit score. These establishments may additionally offer monetary counseling services to help borrowers manage their debts more effectively.

Additionally, some people might discover peer-to-peer lending platforms, which connect borrowers directly with particular person traders. These platforms typically have extra lenient credit score necessities and can provide aggressive interest rates.

Monetary Literacy and Accountable Borrowing

As the popularity of money loans with out credit checks continues to rise, financial literacy turns into increasingly vital. Borrowers should educate themselves in regards to the terms and circumstances of such loans, together with the entire repayment amount and the implications of defaulting. Understanding one's financial scenario and creating a funds can help borrowers make knowledgeable choices about taking out a loan.

Accountable borrowing is crucial to avoiding the pitfalls related to high-interest loans. People should solely borrow what they'll afford to repay and consider their skill to handle extra debt before committing to a loan. It might even be sensible to hunt advice from financial advisors or credit counselors who can present steering tailored to individual circumstances.

Conclusion

Cash loans without credit score checks for quantities equivalent to $5000 can present fast relief for borrowers going through monetary emergencies. Nevertheless, the benefit of access comes with significant duties and potential dangers. Understanding the phrases, being aware of the prices, and recognizing the significance of financial literacy are essential steps for anyone contemplating such a loan. By making knowledgeable decisions and exploring all available options, borrowers can navigate the monetary landscape extra successfully and avoid falling into a cycle of debt.